japan corporate tax rate kpmg

Japan corporate tax rate kpmg. Short-term gains are taxed at a flat rate of 3063 percent including surtax of national income tax plus 9 percent of local inhabitant tax.

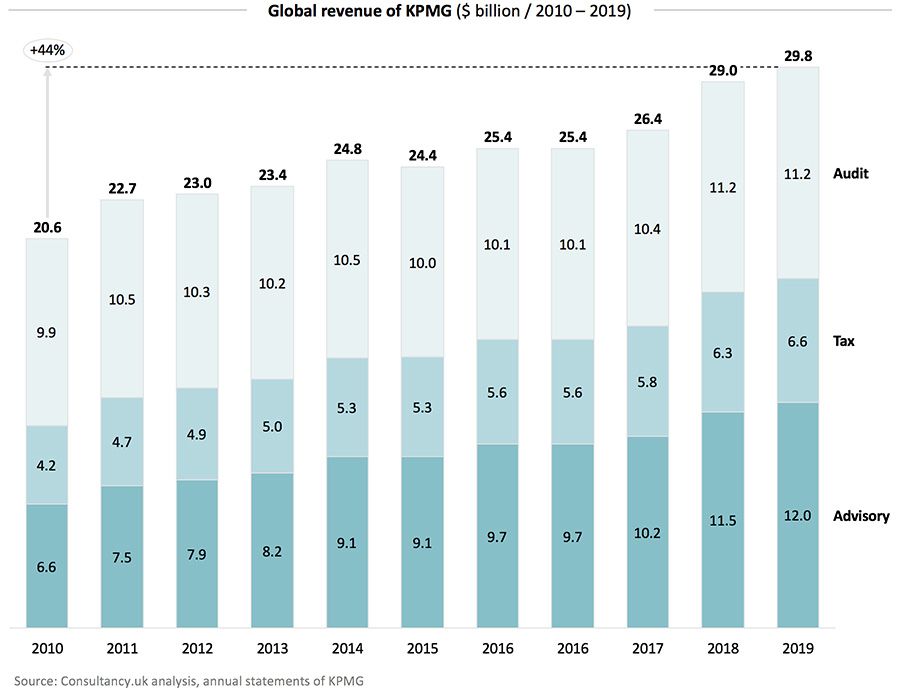

Kpmg Grows Revenues To 30 Billion Advisory Largest Division

Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021.

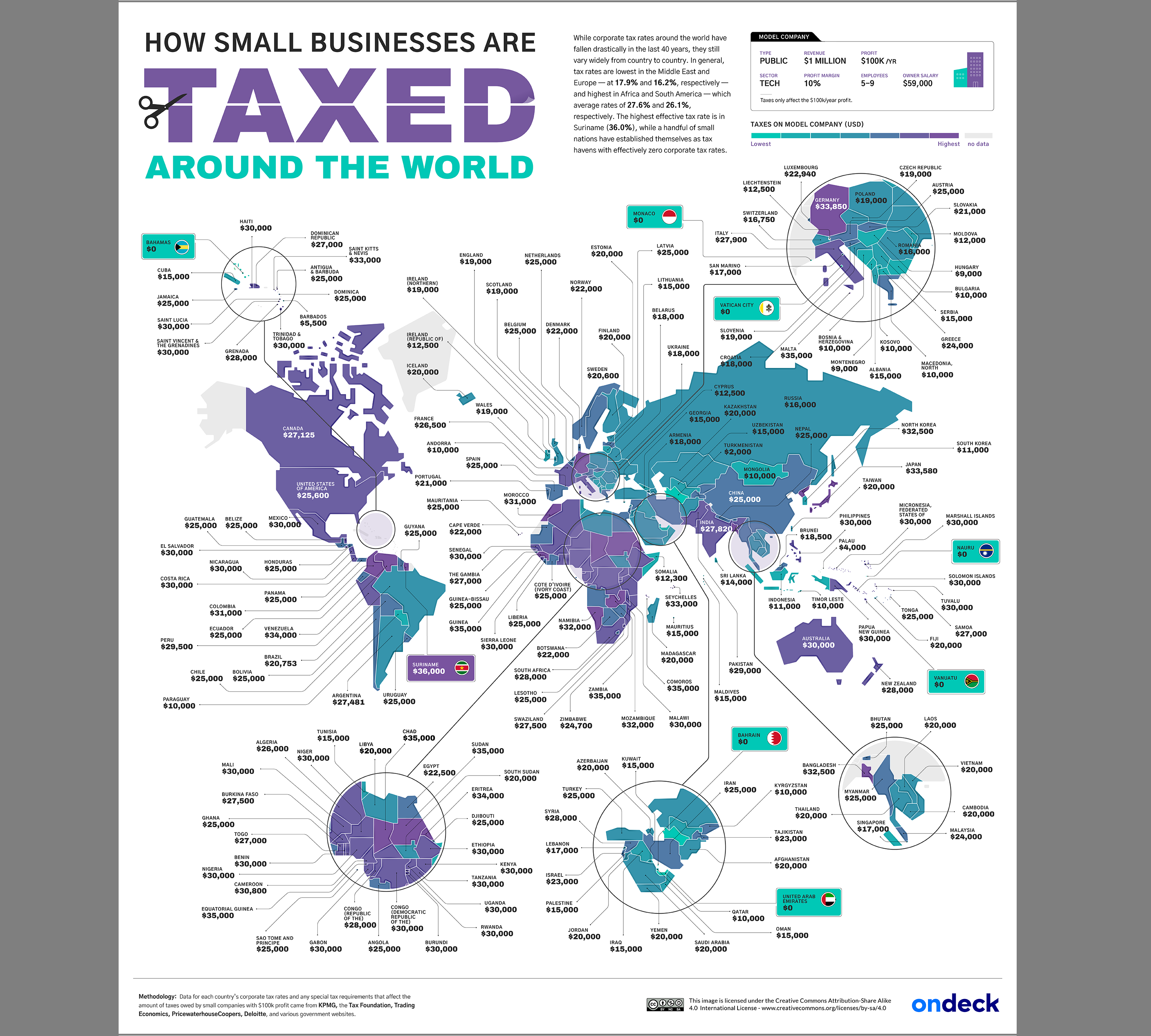

. Regular business tax rates currently apply and vary between 09 percent and 228 percent depending on the tax base taxable income and the location of the taxpayer. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. U u Japan 42 42 26 u u Korea South 308 u u Luxembourg 3745 27 u Malaysia 28 28 28 u u Mexico 35 29 u u.

Tax rates tool test page. 81 3 6229 8000 Fax. Local corporation tax applies at.

Corporate tax for companies with share capital exceeding jpy 100 million 232. Reduction in Special Rate of Interest TaxInterest on Refunded Tax 20 2. Tax Rate Applicable to fiscal years beginning between 1 April 2015 and 31 March 2016 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

The KPMG Japan Tax Newsletter issued on 18 December 2019 focuses on the Japanese Group Relief System. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by. Share with your friends.

KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Local corporation tax applies at 44 percent on the corporation tax payable. The tax rate is 10 of income.

The business tax rates incomerevenue component and the special business tax rate which will be applied to fiscal years beginning on or after 1 october 2019 are as follows. Corporation tax is payable at 255 percent. Tax base Small and medium- sized companies1 Other than small and medium-sized companies Taxable income up to JPY8 million in a year 19 152 232 Taxable income in excess of JPY8 million 232.

Enhance corporate reorganizations and contribute to the maintenance and. 81 3 5575 0766. Kpmg KPMG Corporate Tax Rate Survey January 2001 The KPMG International Tax and Legal Centre is pleased to present its annual survey of corporate tax rates.

Corporate and international tax proposals in tax reform package 19 December 2018. Historical corporate tax rate data. Data is also available for.

Since then the tax practice has strived to continually provide our clients with consistent high quality service that combines among the best of. KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo 106-6012 Japan Tel. Corporate Marginal Tax Rates - By country.

Changes to the controlled foreign corporation CFC regime considering the corporate tax rate reduction in the United States. Insights Industries Services Events Careers About us KPMG Personalization Get the latest KPMG thought leadership directly to your individual personalized dashboard. Contact KPMGs Federal Tax Legislative and Regulatory Services Group at 1 2025334366 1801 K Street NW Washington.

Download as an excel file instead. Tax Rate Applicable to fiscal years beginning before 1 April 2015 Tax rates for companies with stated capital of JPY 100 million or greater are as follows. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

Improving Lives Through Smart Tax Policy. This paper explores how corporate income tax reform can help Japan increase investment and boost potential growth. The corporation tax is imposed on taxable income of a company at the following tax rates.

In this alert we provide an overview of the major reforms and revised provisions contained in the outline. This survey incepted in 1993 covers 5 8 countries including the 29. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when.

Corporation tax is payable at 239 percent. KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. The tax credit will be capped at 20 of the corporate tax amount for a given fiscal year and is a temporary measure that will be implemented for.

2021 Global Withholding Taxes. KPMG in Japan was established when KPMG opened a network office in 1954. Long-term gains are taxed at a flat rate of 15315 percent including surtax of national income tax plus 5 percent of local inhabitant tax.

Amendments to Statute of Limitations for Reassessments or. Special local corporate tax rate is 1526 percent which is imposed on taxable income multiplied by the standard of regular business tax rate. KPMGs corporate tax table provides a view of corporate tax rates around the world.

KPMG Tax Corporations strength is its ability to offer services for a broad range of clients tax needs. 5 rows 73 51 73 53 Over JPY 8 million. Principal International Tax KPMG US.

Japan Tax Update PwC 3 Enterprise tax- Non size based taxation Standard rate April 1 2016 April 1 2018 October 1 2019 Corporate Tax. EY JapanThe fiscal year 2022 tax reform outline was released on 10 December 2021. Local management is not required.

96 67 96 70 Local corporate special tax. Using international and Japan-specific empirical estimates of corporate tax elasticities investment is predicted to expand by.

Taxation In Japan 2020 Kpmg Japan

The Average Corporate Tax Rates In Every Country In The World Digital Information World

Is Us Highest Taxed Country As Trump Claims

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Outline Of The 2021 Tax Reform Proposals Kpmg Japan

World S Highest Effective Personal Tax Rates

India S Big Bang Moment Brink Conversations And Insights On Global Business

Ceo Outlook Pulse Survey Insights For Tax Leaders Kpmg Global

Update Of Q A Japanese Group Relief System Kpmg Japan

Lowest Corporate Taxes In The World

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com

Jp Extended Tax Filing And Payment Deadlines Kpmg Global

Presented By Ayesha Macpherson Tax Partner Kpmg Hong Kong Making The Best Tax Decisions For Your China Business Ventures March Ppt Download

Corporate Tax Rates By Country Corporate Tax Trends Bookkeeperbuddies Com